This update on Bioenergy with Carbon Capture and Storage (BECCS) summarises the latest developments on the Geoengineering Monitor Map, highlighting new trends to aid civil society and climate justice movements in their efforts to oppose geoengineering globally. This update is part one of a two-part update on land-based carbon removal, which will also cover biochar. It was researched and written by Anja Chalmin, and published with the support of the Geoengineering Monitor team.

Critical Bioenergy with Carbon Capture and Storage (BECCS) developments covered in this update:

- Claims by developers that BECCS projects can permanently remove carbon from the atmosphere are still based on incomplete carbon accounting methodologies where large emissions sources are being deliberately ignored;

- The Drax Group’s negative emissions calculations for its BECCS project in the UK assume that burning biomass is carbon neutral, when a large volume of recent studies show this not to be the case;

- Public subsidies remain the driving force behind BECCS projects, although carbon markets are playing an increasingly important role with BECCS projects accounting for the vast majority of Carbon Dioxide Removal (CDR) carbon credit sale agreements in 2024;

- Microsoft’s major new contracts with BECCS projects in Sweden and Denmark for future carbon credit sales account for over 90% of BECCS credit sale agreements, with a BECCS project at Stockholm Exergi’s Värtan biomass CHP plant being the largest single contract by far;

- Fierce opposition to thousands of kilometres of new CO2 pipeline networks in the USA is causing significant delays and cost increases for BECCS pipeline projects, which has resulted in the cancellation of the Heartland Greenway BECCS project;

- The world’s largest BECCS project, Summit Carbon Solutions’ Midwest Carbon Express, which plans to install a large network of pipelines between 57 ethanol plants, has faced lawsuits, public petitions and legislative challenges that have delayed the project by two years and almost doubled project costs;

- An increasing number of BECCS projects including Project Interseqt’s biomass-to-ethanol plants, led by Occidental Petroleum Corporation and White Energy in Texas, are geared towards using captured CO2 for enhanced oil recovery, which would result in significant additional emissions;

- A number of companies are developing new carbon capture technologies for BECCS projects in order to replace current capture processes, but these are also highly energy intensive.

BECCS negative emissions claims are still reliant on incomplete carbon accounting

Companies that claim to be able to generate so-called negative emissions with BECCS are relying on limited Life Cycle Assessments (LCA) where significant sources of greenhouse gas emissions are not fully (or not at all) accounted for. These sources of emissions include land-use change, CO2 leakage when the captured carbon is injected underground (CCS) or the often inevitable re-release of the captured carbon if it is put to alternative uses (CCUS). Similarly, potential impacts on ecosystems and ecosystem services are not fully considered either, if at all.

In the case of biomass cultivated specifically for use in energy generation, LCAs should include each of the supply-chain processes such as the energy required for all cultivation, harvesting, transportation, drying and processing, and the potential environmental impacts of fertiliser use, water consumption and soil degradation. This is particularly relevant for BECCS projects that use agricultural biomass to produce ethanol, which is currently predominantly corn. Growing corn typically requires large amounts of fertilisers and often accelerates soil erosion and degradation. The operation of ethanol plants also generates emissions through multiple processes. Usually, only emissions from the fermentation process are considered, but this accounts for less than half of the total emissions when all sources are taken into account. When complete LCAs are carried out, the combustion of ethanol is shown to be more carbon intensive overall than the combustion of gasoline.

Larger BECCS projects that burn wood from forests and plantations, such as those planned by the Drax Group in the UK and USA, require large quantities of whole trees due to the lack of available residual biomass. Drax presents its BECCS proposals as carbon negative, but fails to take into account, among other things, that forestry and all subsequent operations release significant emissions, and that had the trees not been felled to burn for energy, they would have continued to grow and sequester more CO2. The use of biomass for energy generation creates a carbon debt that may eventually be offset by the regrowth of trees, but regrowth takes time, usually many decades, meaning that biomass energy can almost never be considered carbon neutral within meaningful timescales. The European Academies’ Science Advisory Council (EASAC) concludes that “there are substantial risks of [BECCS] failing to achieve net removals at all, or that any removals are delayed beyond the critical period during which the world is seeking to meet Paris Agreement targets to limit warming to 1.5–2°C.”

On top of this, there isn’t yet a UNFCCC/IPCC carbon accounting methodology that would allow countries to claim “negative emissions” from BECCS. The IPCC is due to publish such a methodology in 2027, but until then it remains uncertain whether, in the case of imported biomass, carbon removals attributed to BECCS would be credited towards the country capturing the CO2 or the country exporting the biomass. In the meantime, companies developing BECCS projects as well as voluntary carbon offset schemes are making up their own methodologies which may well contradict the UNFCCC/IPCC one, once that has been agreed.

The availability of biomass is a key element for the development of BECCS projects, and using biomass for energy generation competes with other uses of it, such as for food, animal feed and bedding, construction materials, furniture and paper. Competition for biomass has increased steadily in recent years in places with large bioenergy capacities such as the EU. The lack of available biomass requires many biomass power plants to transport large amounts of biomass over long distances, increasing the already large footprint of BECCS projects and limiting their scalability.

Furthermore, the large land footprint that bioenergy generation requires is inefficient compared to other so-called renewable options such as solar and wind energy, which currently produce 50 to 100 times more energy per unit area. Less ecologically sensitive areas and rooftops can also be used to generate wind or solar energy, and the cost of solar energy is already less than US$ 0.02 per kilowatt hour in some cases, and less than US$ 0.06 per kilowatt hour for offshore wind in Europe. The cost per kilowatt hour of burning solid biomass ranges from US$ 0.08 to US$ 0.17, and biogas from US$ 0.09 to US$ 0.19, and these figures do not include the costs of CCS or CCUS that would be required for BECCS.

Drax Group, UK: BECCS project at Selby power station reliant on public funding

The Drax Group has gained government approval for a BECCS project at its Drax Power Station, the UK’s largest power station, in Selby, North Yorkshire. Drax has converted four of six coal-fired boilers to burning wood pellets, and plans to equip two of the boilers with post-combustion CO2 capture technology supplied by Mitsubishi Heavy Industries in order to capture up to eight million tonnes of CO2 per year. It then plans to pipe the captured CO2 for injection into geological formations under the North Sea. Drax says that this will achieve a “negative carbon footprint,” since it claims that burning biomass is carbon neutral, and that new tree growth reabsorbs carbon emitted from the smokestack.

Drax imports most of its biomass feedstock from North America, where it owns nearly 20 wood pellet plants. In addition, the pellet production process is energy intensive, as the biomass feedstock has to be dried, milled, pelletised and shipped across the Atlantic. There have also been repeated reports that Drax is sourcing wood for its pellets from primary forests in North America, in some cases from rare old growth forests.

The final investment decision for the project is still pending and is expected in 2026, with Drax aiming to start BECCS operations in 2030. The BECCS project has already received at least seven million pounds in public funding and in 2024, the UK government approved further funding, with one estimate finding that subsidies for the project could cost £1.7 billion a year up until 2050. In addition, the Drax plant has already benefited from large subsidies for biomass electricity generation, totaling around £ 1.4 billion between 2018 and 2022.

Drax had previously announced a BECCS project involving the construction of a new power plant at the same site which, despite having received £50 million in public funding, was cancelled in 2015 due to high costs. For more information on the campaign against Drax’s new BECCS project and the impacts of its wood sourcing more generally, visit the Biofuelwatch website.

Toshiba, Japan: Japanese company purchasing biomass in Indonesia

Toshiba’s BECCS project at its 50 MW coal and biomass Mikawa Thermal Power Plant in Omuta City was launched in 2009 as part of a research programme funded by Japan’s Ministry of the Environment. Toshiba describes it as a large-scale project and claims that the unit captures more than 50 % of the power plant’s smokestack emissions, although it only captures up to 200,000 tonnes of CO2 annually. The company’s carbon capture claim does not take into account that the plant burns 200,000 tonnes of palm kernel shells per year, mainly imported from Indonesia. Importing biomass over distances of several thousand kilometres, about 5,000 linear kilometres in this case, is a significant source of emissions that will not be captured.

NorthStar Clean Energy and Tondu Energy Corporation, USA: Converting the TES Filer City Station coal plant to BECCS

In 2023, NorthStar Clean Energy and Tondu Energy Corporation proposed converting their 75 MW coal-fired TES Filer City Station power plant in Michigan to biomass with CO2 capture. NorthStar and Tondu plan to source biomass from the adjacent Manistee National Forest or to ship it to the Filer City dock from nearby ports on Manistee Lake with access to Lake Michigan. The CO2 capture process will be based on Babcock & Wilcox’s SolveBright post-combustion technology, and the captured CO2 will be piped for injection into geological formations in northern Michigan. An initial engineering study is underway and a final investment decision is expected by the end of 2024. The conversion could take advantage of the 45Q tax credit system, a subsidy of US$ 85 per tonne of CO2 captured and injected into geological formations provided through the USA’s Inflation Reduction Act.

Public finance is the main driver behind BECCS projects, but carbon credits are becoming increasingly important

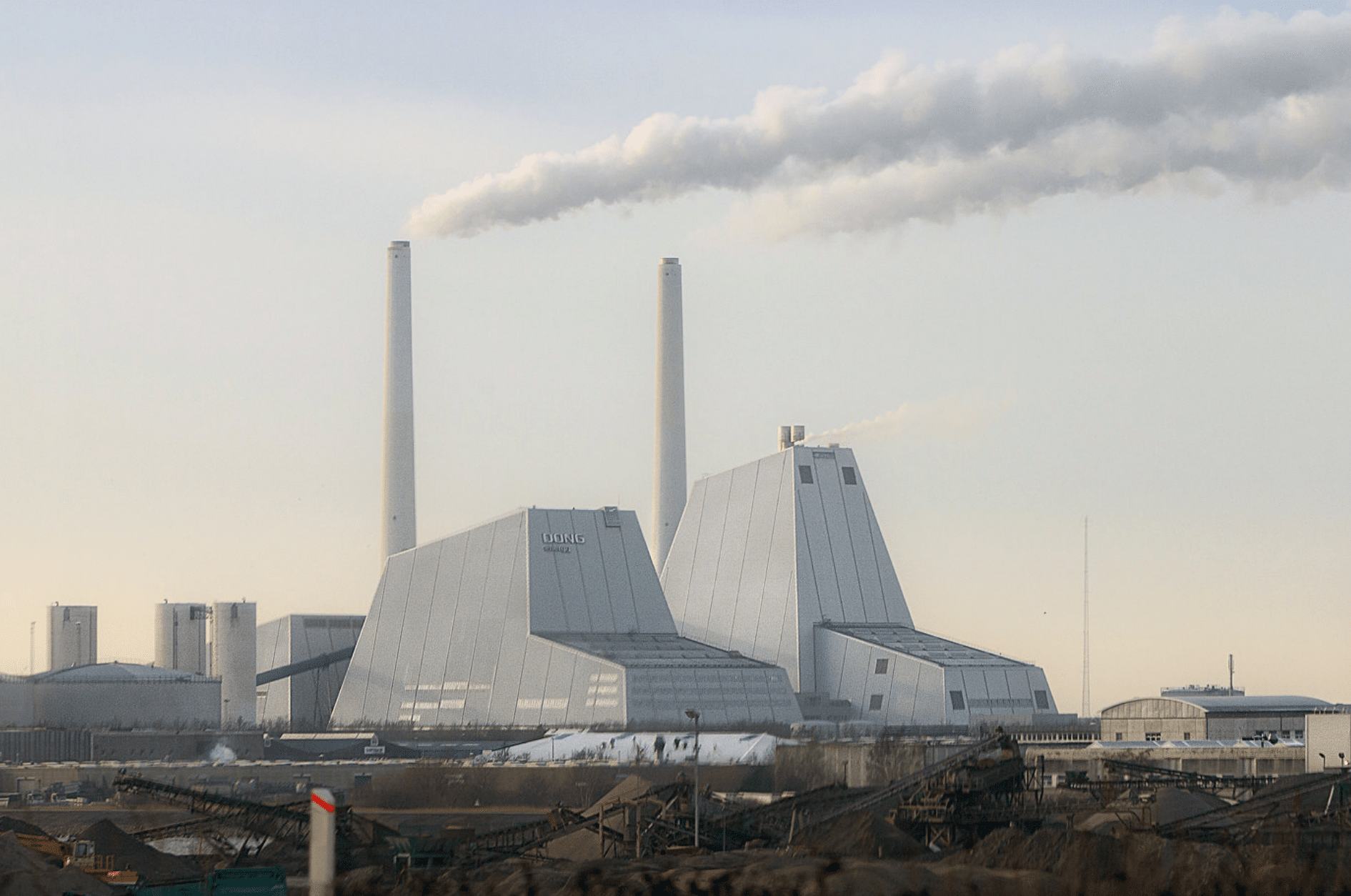

Due to the significant costs involved in implementing BECCS projects, they depend on support from public funds and, in the case of many relatively new projects, long-term contracts for the sale of carbon credits. As a consequence, BECCS has recently established itself as the most popular Carbon Dioxide Removal (CDR) carbon credit product. In the second quarter of 2024, BECCS projects accounted for nearly 90% of CDR credits sold globally, representing around 4.3 million tonnes of carbon. The main driver for this is Microsoft’s major investments in BECCS projects in Sweden (Stockholm Exergi) and Denmark (Ørsted), which account for 91% of the total BECCS credit value, although it should be noted that these are uptake agreements for future carbon capture that hasn’t yet begun. Despite the rise in prominence of carbon markets, public funding remains the biggest driver for BECCS, with large subsidies for BECCS projects having recently been awarded in Sweden, the USA and the UK.

Stockholm Exergi, Sweden: World’s largest BECCS carbon credit contract signed with Microsoft

The Swedish energy company Stockholm Exergi AB, owned by the City of Stockholm and Ankhiale Bidco AB, a European consortium of investors, plans to install a CO2 capture plant at its biomass-fired combined heat and power (CHP) plant in Stockholm. If this project is successful, Stockholm Exergi plans to replicate it at other CHP sites in the region.

The project involves transporting captured and liquefied CO2 by ship for injection under the North Sea. For the handling of the captured CO2, Stockholm Exergi anticipates partnering with Northern Lights, a Norwegian CCS project, and a recent cooperation agreement between Sweden, Norway and Denmark on CO2 storage would facilitate this. The Swedish Land and Environmental Court granted a permit for the project in April 2024, but the final investment decision is still pending.

In 2024, major carbon credit contracts were signed with Microsoft and Frontier, and the company is trying to secure additional contracts before the end of the year. As well as receiving funding in the future through carbon credit sales, the project has also received €180 million from the EU Innovation Fund, and is likely to receive further public finance given that in July 2024 the European Commission approved Sweden’s plan to provide up to €3 billion in subsidies for Swedish BECCS projects, with selected projects receiving a subsidy per tonne of CO2 captured and injected underground for a binding period of 15 years.

Söderenergi AB, Sweden: Igelsta CHP plant targets public finance and carbon credits

Söderenergi AB, a Swedish energy company, plans to install a BECCS unit at its Igelsta CHP plant in Södertälje, Sweden’s second largest biomass CHP plant. The plant is fueled with forestry residues, wood pellets, tall oil and solid recovered fuel. The biomass is delivered by ship and rail, and the proposed BECCS project would use the same port to ship captured and liquefied CO2 for injection into geological formations under the North Sea. A first feasibility study for the proposed project was carried out in 2021 and 2022, and a contract for a second feasibility study was awarded in 2023. According to Söderenergi, as of October 2024 the BECCS project “has now reached the fourth phase. The overall goal for this phase is to reach an investment decision and start building a BECCS plant with commissioning in 2030. In addition to this, the logistical chain for the removed carbon dioxide needs to be contracted.” In September 2024 the Swedish Energy Agency announced funding of SEK 75 million for the project and, if implemented, it would also benefit from recently approved government subsidies for BECCS projects in Sweden and the sale of carbon credits.

Elimini, USA: Drax Group rebrands its operations in the USA and targets carbon credit sales

The UK-based Drax Group has been expanding into North America since 2021 and announced a new subsidiary in the USA, Elimini, in September 2024. Led by Will Gardiner and Laurie Fitzmaurice, Elimini is currently evaluating over 20 potential BECCS project sites in the USA and has secured eleven carbon credit contracts with C Zero Markets, ClearBlue Markets, Climate Trade, Holborn Trading, Karbon-X, N Value Environmental Energy, Patch, Respira and Ultrabulk and others. In addition, the Drax BECCS sites in the USA could take advantage of the 45Q tax credit system.

Uisa, Brazil: Nova Olímpia corn-to-ethanol plant

In 2020, Uisa, a large Brazilian biorefinery company and producer of corn and sugarcane, announced plans to sell up to 200,000 carbon credits per year and, in 2023, revealed plans to capture CO2 at its Nova Olímpia corn-to-ethanol plant in Mato Grosso. Uisa intends to inject the captured CO2 into the Parecis Sedimentary Basin, approximately 15 kilometres from the plant, and to construct a pipeline to transport the compressed CO2 to the injection site. Drilling is scheduled for 2024 and construction is expected to begin in 2025.

Inherit Carbon Solutions AS, Norway: Carbon capture at biogas plants

Founded in 2021, the Norwegian company Inherit Carbon Solutions AS plans to capture CO2 from Scandinavian biogas plants that convert food waste into methane and sell carbon credits in the process. The captured CO2 will be injected into geological formations in Stenlille, Denmark, in cooperation with Gas Storage Denmark. In 2023, Inherit and announced plans to “remove gigatons of CO2 from the atmosphere and securely storing it for millennia” and signed contracts for the sale of carbon credits to Microsoft, Drax and other companies. The number and location of the biogas plants, the project timetable and the means of transporting the captured CO2 to the injection site have not yet been disclosed.

South Pole and Airfix, France & Switzerland: BECCS projects at four biogas plants

In 2023, South Pole, its subsidiary Airfix and CO2 Energie AG announced plans for a BECCS project at an undisclosed biogas plant near Zurich, Switzerland. The proposed project aims to capture CO2 using post-combustion amine capture technology, liquefy it and transport it by truck, train and ship to northern Europe for injection into a geological formation. The project is expected to be operational in 2025, and the Swiss Climate Cent Foundation has guaranteed the purchase of CO2 credits worth ten million Swiss francs by 2030.

In 2024, South Pole, Airfix and Carbon Impact announced BECCS projects at three biogas plants near Nancy, France. The biogas plants are operated by Meurthenergie, Mortagne Environment and Méthanisation Seille Environnement, and use agricultural waste, mainly manure and slurry. The CO2 capture technology and transport methods are similar to those of the Swiss project. Carbon Impact will be responsible for all of the CO2 capture infrastructure, Airfix for the CO2 transport and South Pole for marketing the carbon credits.

Evero, UK: Carbon capture at Ince and Mersey waste wood plants

Evero (formerly BIG) plans to generate carbon credits by retrofitting CO2 capture units at its Ince and Mersey biomass gasification plants in Cheshire and Widnes which, according to the company, burn locally-sourced waste wood.

At the Cheshire site, the project started with a government-funded feasibility study to install a small-scale CO2 capture unit using UK-based C-Capture Ltd’s capture technology. The small-scale project was not implemented and, in 2023, Evero announced that it would instead use Mitsubishi Heavy Industries’ amine solvent-based capture technology.

In October 2024, both projects passed a government assessment and will proceed to a publicly funded second phase, which aims to install a 0.2 million tonne CO2 capture unit at each plant. The captured CO2 will be transported to the nearby HyNet CC(U)S cluster for injection into an underground geological formation.

Planned BECCS CO2 pipeline networks in the USA are facing strong opposition

There are several major BECCS projects in the USA involving the construction of thousands of kilometres of CO2 pipelines. Residents along the pipeline routes are particularly concerned about gas leaks that could endanger people and animals. There are also fears that the construction of the pipelines will damage farmland, drainage and waterways, and that the CO2 will escape from the geological formations it is injected into. In addition, there have been repeated reports of pressure being put on landowners that object to pipeline construction on their land, and a lack of transparency in communication from the companies involved. Ongoing protests and procedural issues have led to spiraling costs and projects being delayed and, in one case, abandoned.

Navigator CO2 Ventures: Heartland Greenway BECCS project cancelled due to safety concerns

The Heartland Greenway BECCS project involved the construction of a 2,000 kilometre pipeline network to pump captured and liquefied CO2 from more than 30 ethanol plants into the Mt. Simon sandstone formation in central Illinois. Navigator CO2 Ventures and its partners initiated the project in March 2021 and cancelled it in October 2023, despite having already signed agreements with the carbon credit sales platform Puro.earth and with Infinium for the purchase of its e-fuels. The project faced strong opposition from local residents and landowners from the outset, who highlighted concerns about negative health and soil impacts and potential gas leaks along the proposed pipeline network and at the proposed storage site. Landowners also complained about a lack of transparency from the project developers, and state officials cited a lack of landowner support for the project. Navigator’s official explanation for the cancellation of the project was the regulatory issues it had encountered, which included the denial of a pipeline construction permit on safety grounds following the submission of incomplete data on potential CO2 leaks.

Summit Carbon Solutions: Midwest Carbon Express BECCS project experiences delays and cost increases

The world’s largest planned BECCS project, the Summit Carbon Solutions Midwest Carbon Express, aims to build a 3,200 kilometre pipeline network across five states in the USA to transport up to 18 million tonnes of captured CO2 per year to an underground injection site near Bismarck, North Dakota. To date, 57 ethanol plants have joined the project. The project has been in development since 2021 and was originally scheduled to be operational in the second quarter of 2024, but is now more than two years behind schedule. The delays have contributed to the project’s costs rising from an estimated US$ 4.5 trillion in 2022 to US$ 8 trillion in May 2024, and have led to a lawsuit being filed by pipeline manufacturer Welspun Tubular against the project’s developers. The permitting and eminent domain (where landowners are obliged to allow developments to take place on their land) processes for the proposed network of CO2 pipelines have not yet been concluded in four of the five affected states, although they have been conditionally approved in Iowa.

Following the cancellation of the Heartland Greenway BECCS project, two of the companies that had been participating in it have since joined the Midwest Carbon Express project. This allowed Summit to add another 25 ethanol plants to its project, and it also acquired some of Navigator’s old land easement agreements. South Dakota-based POET LLC is the largest biomass-based ethanol producer in the United States, and 18 of its 34 plants are now participating in the Midwest Carbon Express project. POET LLC is already capturing CO2 on a small scale and selling it to customers in the Midwest for use in consumer products. Valero Energy, an oil corporation, now has eight plants participating in the Midwest Carbon Express project.

The Midwest Carbon Express project has also faced fierce opposition from Indigenous communities, local residents, landowners and other stakeholders from the outset. Recent examples include landowners collecting signatures to force a referendum on the project and suing Summit over its aggressive land acquisition campaign, residents filing a lawsuit challenging the approval of CO2 pipelines on the grounds that eminent domain should be reserved for projects in the public interest, moratoriums against the pipeline being introduced in several counties and legislators in Bismarck, North Dakota, the city closest to the proposed CO2 injection site, calling for a 25-mile residential setback from the pipeline.

A further criticism made by those opposing the project is that Summit is no longer ruling out using the captured CO2 for enhanced oil recovery. Although Summit’s website still notes that the “project will not be used for enhanced oil recovery,” in an interview with the North Dakota Monitor the company stated that “the pipeline could be used for enhanced oil recovery in the future with the right agreement with a customer.”

Summit Carbon Solutions intends to finance the project with public and private funds, with the main public source being a subsidy via the 45Q tax credit system. In addition, Summit plans to sell carbon credits and has already entered into agreements with the Anew Climate and NextGen carbon markets.

Archer Daniel Midland (ADM): Proposed BECCS projects in Cedar Rapids and Clinton delayed

In 2022, multinational food processing and commodity trading corporation ADM announced plans to expand its CCS project in Illinois by capturing CO2 from its corn-to-ethanol plants in Cedar Rapids and Clinton, Iowa. In the same year, ADM and Wolf Carbon Solutions signed a letter of intent to build a 450 kilometre pipeline to transport the captured CO2 from the plants to ADM’s CO2 injection site in Illinois. In the following year, Wolf filed a permit application with the Iowa Utilities Board to develop and operate the CO2 pipeline system, but had to withdraw it because it did not meet the required conditions for consideration, which included the project having a legally binding agreement with ADM, sufficient public interest and a finalised pipeline route. Wolf is expected to resubmit an application. ADM and Wolf had announced that construction would begin in 2024 with operations starting in 2025, but this timeline has been delayed and there is currently no information on when the project will be implemented, if at all.

There have also been public protests against this pipeline project by groups such as Citizens Against Predatory Pipelines (CAPP), who fear that it will endanger local residents, threaten their property rights and destroy farmland.

Tallgrass Energy: Conversion of natural gas pipeline to CO2 delayed

The Trailblazer pipeline has operated since 1981 and was acquired in 2022 by Tallgrass Energy Partners L.P., an energy and infrastructure company. In 2022, Tallgrass proposed converting 630 kilometres of its pipeline system from transporting natural gas to CO2. The conversion is part of Tallgrass Energy’s Eastern Wyoming Sequestration Hub, a project aiming to capture CO2 from ethanol plants and other industries in Nebraska, Colorado and Wyoming, and to transport up to 10 million tonnes of CO2 to a geological injection site near Cheyenne, Wyoming. An agreement to connect ADM’s Columbus corn-to-ethanol plant in Nebraska to the pipeline was signed in 2022, and Tallgrass Energy expected its CCS Hub and the Trailblazer pipeline to be operational in 2024, but the project has been delayed and no new timeline has been released.

According to the National Petroleum Council, it is not practical to use existing natural gas pipelines to transport CO2 over long distances because the pipeline pressure is too low. This type of conversion is currently not covered by any federal pipeline safety standard, and the Pipeline and Hazardous Materials Safety Administration has announced that it will be updating its CO2 pipeline regulations, following an accident caused by the rupture of a CO2 pipeline operated by Denbury in 2020, near the community of Sataria, Mississippi, that hospitalised dozens of people. Environmental groups such as the US Pipeline Safety Trust say that ruptures in CO2 pipelines can be life-threatening and contribute to climate change.

Biomass-based CCUS and enhanced oil recovery

Some projects capture CO2 and process it into products such as methanol and urea, rather than injecting it underground. The process of capturing, transporting and processing CO2 is very energy intensive, mainly because CO2 is an inert (non-reactive) gas. Once the products are used or consumed, the CO2 they contain returns to the atmosphere.

Captured CO2 is also used for enhanced oil recovery, which involves pumping pressurised CO2 into ageing oil and gas reservoirs to recover remaining reserves that would otherwise be inaccessible. This significantly increases fossil fuel production and is particularly common in CCS projects, with some BECCS projects also turning to this approach.

Saudi Basic Industries Corporation (SABIC), Saudi Arabia: Al Jubail ethylene plant

The Saudi Basic Industries Corporation (SABIC), a Saudi Arabian chemicals and metals group, has implemented a BECCS project at its ethylene plant in Al Jubail with support from Saudi Arabia’s Circular Carbon Economy National Programme and the Saudi Ministry of Energy. The captured CO2 is used to produce products such as methanol and urea.

Clean Energy Systems, USA: Mendota BECCS project

In 2021, Clean Energy Systems announced a BECCS project in Mendota, California, which it expects to be operational by 2025. The project plans to gasify agricultural biomass, including residues from almond orchards. The resulting CO2 will be captured and stored underground in a nearby geological formation or used for products such as synthetic fuels. The project appears to be delayed and there is no indication that construction has started.

Velocys PLC, USA: Bayou Fuels Plant

In 2019, Velocys announced plans for a biomass-to-fuel project in Natchez, Mississippi. The Bayou Fuels Plant will gasify woody biomass, capture CO2 and produce synthetic jet fuel. In addition, Velocys has signed an agreement with Oxy Low Carbon Ventures to transport and inject the captured CO2 into geological formations. Velocys has not yet confirmed if it has succeeded in securing financing for the plant, and there is no indication that construction will begin any time soon.

Occidental Petroleum Corporation and White Energy, USA: Project Interseqt

Project Interseqt, proposed by Occidental Petroleum Corporation and White Energy, plans to capture CO2 at White Energy’s West Texas biomass-to-ethanol plants in Plainview and Hereford, and to transport the captured CO2 to Oxy’s West Seminole field in the Permian Basin for use in enhanced oil recovery. The BECCS project was announced in 2019 and the commissioning of the CO2 capture units was set for 2021, although this has now been delayed until 2026. Project Interseqt aims to take advantage of the 45Q tax credit system, which incentivises CO2 storage through enhanced oil recovery and utilisation as well as geological storage.

New technology developments and other projects

New technological approaches are being developed to replace CO2 capture processes that are reliant on using chemical solvents with water to remove CO2 from flue gases. However, due to the high pressures and temperatures involved, new capture processes are also energy intensive. In addition, there are efforts underway to develop smaller BECCS modules that can be applied to small-scale projects.

KEW Technology, UK: Replacing amine-based CO2 capture

KEW Technology is a developer of a CO2 capture technology known as Carbon Capture and Hydrogen Purification (CCH2), which separates CO2 from H2 in the flue gas stream. Under pressure, the CO2 is absorbed into water, but the H2 is not. Once the pressure of the CO2-rich water is reduced, the CO2 is released and can be captured. KEW plans to deploy the technology at its biomass gasification plant in Wednesbury, UK. The company has been awarded £ 4.4 million from the UK Department of Energy Security & Net Zero’s Hydrogen BECCS Innovation Programme, although the planned CO2 capture capacity and the timing of the project are not yet publicly known.

Compact Syngas Solutions, UK: Replacing amine-based CO2 capture

Compact Syngas Solutions Ltd, based in Deeside, Wales, is currently demonstrating a CO2 capture process that uses water to separate CO2 from flue gases, with the aim of replacing amine-based CO2 capture processes. The process is being tested at Compact’s biomass-to-hydrogen plant in Deeside in preparation for commercialisation. The biomass gasification process produces syngas from waste wood, wood chips, compost oversize, tea prunings, refuse derived fuel pellets and bagasse from sugar production. The syngas can then be used to produce heat and power, green hydrogen or biocrude. Following the project, Compact plans to build and market modules that combine H2 production with CO2 capture and, since 2022, the company has received more than four million pounds in public funding.

Arbor Energy and Resources Corporation, USA: Development of modular BECCS systems

Arbor Energy was founded in 2022 to develop and demonstrate a smaller modular biomass gasification plant for CO2 capture, with undergrowth, crop residues and food waste cited as potential biomass sources. According to the Californian company in June 2024, the “waste biomass is collected, it’s chipped and shredded to make it easier to transport to our power stations” and then gasified into syngas. The syngas is mixed with oxygen and burned to produce energy, CO2 and water. The CO2 will be captured, compressed and piped for injection into geological formations. There is no indication yet of when Arbor’s first module will be operational, but the company already has several carbon credit customers, among which are the carbon markets Frontier, Shopify and Stripe. In September 2024, Arbor signed a deal with Microsoft for the sale of 25,000 carbon credits, starting in 2027. Arbor Energy has received public funding from the California Department of Conservation and other sources, and funding from private investors in two undisclosed funding rounds, including from Countdown Capital, Cantos Ventures, Gigascale Capital, Silent Ventures, Lowercarbon Capital and Voyager Ventures.

AstraZeneca and Future Biogas, UK: Using food crops to produce biogas

In 2023, AstraZeneca signed a 15-year biomethane offtake agreement with biofuel producer Future Biogas in Lincolnshire, UK. The syngas is expected to produce 100 gigawatt hours per year at AstraZeneca’s manufacturing sites in Macclesfield, Cambridge, Luton and Speke. A CO2 capture unit will be added to the Future Biogas plant and the captured CO2 will be transported to the North Sea for injection into offshore geological formations. The biomass, crops such as maize, barley and rye, will be sourced from Grange Farm, approximately 10 kilometres north-west of the biogas plant, and AstraZeneca claims that it will reduce its greenhouse gas emissions through the project.

If such BECCS projects are implemented on a larger scale, they are likely to result in challenges regarding land use, food security and water supply. If biomass for BECCS is grown on land that could also be used to grow food, increasing competition will have an increasingly negative impact on food supply and prices. If grown on a large scale, bioenergy crops can also exacerbate water shortages, cause additional emissions through land-use change and pose an increasing threat to biodiversity.

FS Agrisolutions Indústria de Biocombustíveis Ltda (FS), Brazil: FS Lucas do Rio Verde biomass-to-ethanol refinery

FS Agrisolutions Indústria de Biocombustíveis Ltda (FS) announced plans to invest R$ 350 million (US$ 65 million) into a BECCS project at its FS Lucas do Rio Verde corn-to-ethanol refinery in the state of Mato Grosso, Brazil. The refinery is powered by a biomass plant which mainly burns wood from eucalyptus plantations, but also bamboo, sawmill residues, sawdust, sugarcane bagasse and rice husks. FS conducted an initial feasibility study in 2021 and in October 2024 announced that the nearby Diamantino geological formation was suitable for injecting captured CO2 underground, but it is not yet publicly known who conducted the study. FS has also announced plans to expand its BECCS project to other industries.

FS is a joint venture between Summit Brazil Renewables LLC, a subsidiary of Summit Agricultural Group, and Tapajós Participações S.A. As already discussed, the US-based Summit Carbon Solutions, another subsidiary of the Summit Agricultural Group, is currently seeking to implement a BECCS project with a 2,000-mile pipeline network in the USA.